Αll global ocean carriers saw revenues increase substantially as a consequence of the record-high freight rates, with year-on-year revenue growth ranging from 83.9% for Maersk to 274.1% for Wan Hai, αccording to data from Sea-intelligence.

In terms of earnings before interest and taxes (EBIT), the shipping lines made a whopping US$37.24 billion in operating profit in Q3 of 2021 alone, according to the Danish firm.

“Combine this with the 2021 first half operating profit of 42.10 billion, and the carriers have made nearly US$80 billion in operating profit so far this year,” noted Alan Murphy, CEO of Sea-Intelligence.

This does not include MSC, the world’s currently second-largest carrier, which as a privately held company is not required to publish its accounts.

“To put this into perspective, the combined 2010-2020 operating profit across all quarters was US$37.86 billion,” added Murphy.

In short, the industry has doubled its operating profit during the three quarters of the year, compared to the entire 10 year period of 2010-2020, reflecting an unprecedented level of profitability.

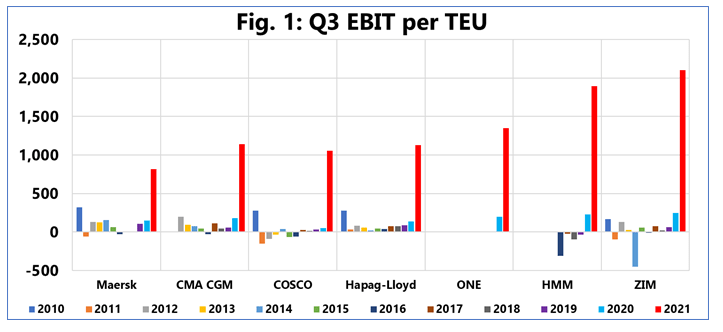

The absurd nature of the current supply/demand and freight rate environment is evident in the above figure, with the 2021 Q3 EBIT/TEU figure of each of these shipping lines a clear outlier compared to the “historical” figures.

The smallest EBIT/TEU was recorded by Maersk of US$818/TEU, while the remaining carriers all recorded EBIT/TEU of over US$1,000/TEU, with ZIM recording an EBIT/TEU of US$2,100/TEU, according to Sea-Intelligence’s data.

“What sheds even more light on the strength of the freight rates, is that a large number of carriers have seen their Global, Transpacific, and Asia Europe transported volumes contract year-on-year, which means that the exceptionally strong EBIT performance for all carriers was driven by strong freight rates,” commented the company’s CEO.