A new UNCTAD report estimates the export value in ocean-based industries at $2.5 trillion, according to the latest available data, covering 2018.

The report, entitled “Advancing the Potential of Sustainable Ocean-Based Economies: Trade Trends, Market Drivers And Market Access”, draws on a recently published novel international ocean economy classification.

The figure constitutes the first conservative benchmark from which to measure the evolution of trade in ocean-based goods and services.

The methodology used is groundbreaking, as it’s the first time that ocean- and land-based activities are separated using UN Comtrade data under the Harmonised System nomenclature for each country.

“This report contributes to better understanding, regulating and managing trade in ocean-based goods and services,” said David Vivas, an UNCTAD legal officer working on ocean economy issues.

“It’s an important step forward in advancing progress on the trade-related targets of Sustainable Development Goal 14 on life under water.”

Five ocean economy pillars

The report assesses sustainability using UNCTAD’s five ocean economy pillars, which add to the traditional economic, environmental and social sustainable development pillars.

It also considers the relevance of science and technology as well as regulatory trade, fisheries and law of the sea frameworks.

The report answers the call of the Bridgetown Covenant adopted at UNCTAD’s 15th quadrennial conference, requiring the organization to “devise approaches to stimulate economic diversification and promote higher value-added production”.

The report also provides useful analysis for preparations for next year’s UN Second Oceans Conference in Lisbon.

Biggest ocean-based industries

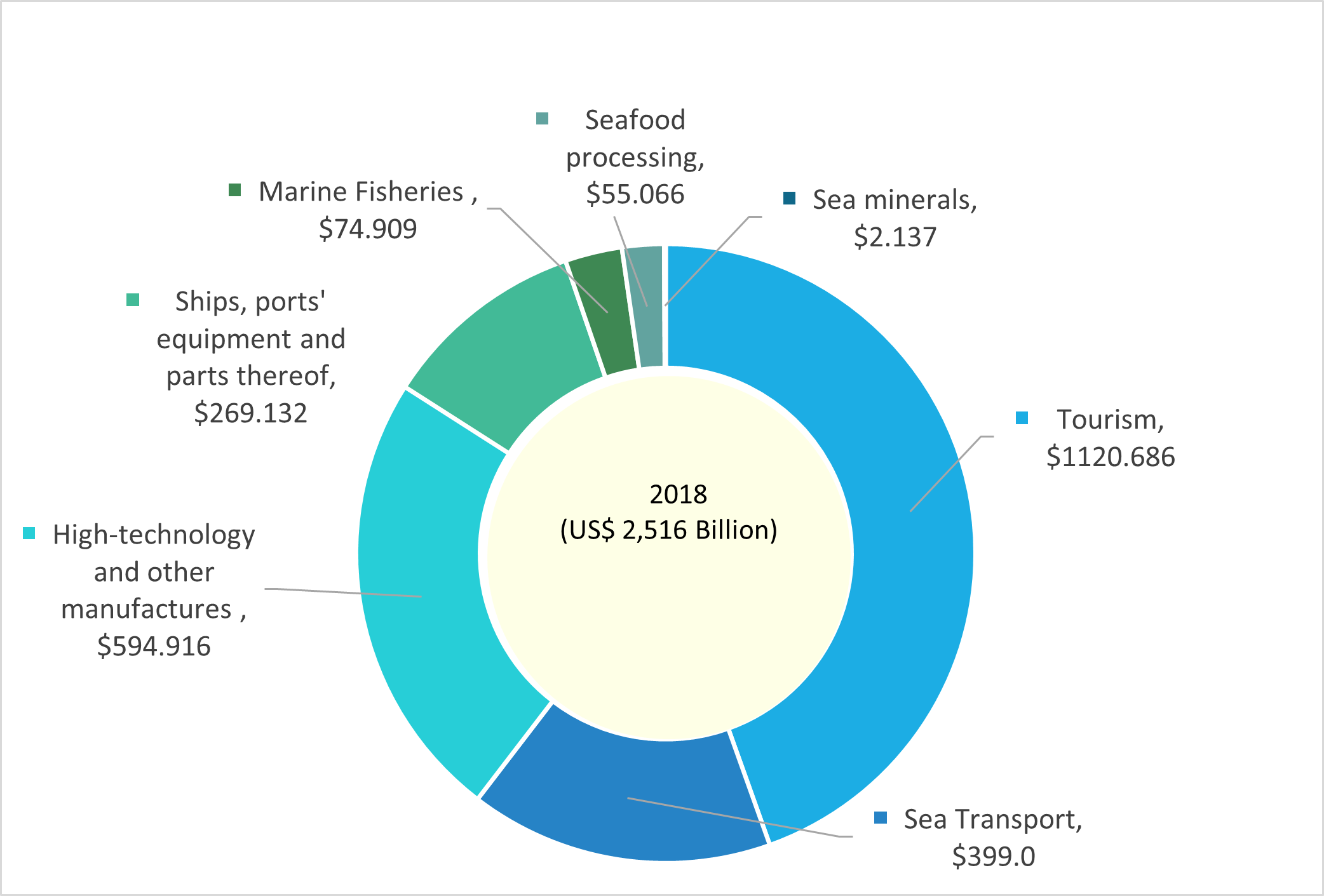

The biggest ocean-based industries in 2018, according to the report, were coastal and marine tourism ($1.1 trillion), followed by marine high technology and other manufactures not classified elsewhere ($595 billion) and maritime transport services ($399 billion).

Source: UNCTAD calculations based on UNCTADStat and World Travel and Tourism Council data (2020).

For goods, the largest sectors were those with higher added value: marine high-technology manufactures, ships, port equipment and parts thereof.

The leading exporters of ocean-based goods are developed countries from Europe, developing countries from Asia (even when China is excluded), followed by countries in the Americas (developed and developing).

A double-digit average export growth was observed for certain products with high added value, such as frozen finfish parts and fillet in the case of marine fisheries between 2016 and 2018, showing increased consumption trends, particularly in Asia, Europe and North America.

The leading exporters of ocean-based goods and services were developed countries in Europe, followed by developing countries in Asia and countries in the Americas.

Due to data limitations, not all ocean-based industries – and particularly various services sectors – could be analysed, pointing to the necessity of better reporting.

Market trends in ocean activities

The period 2015 to 2018 saw more countries participating in less traditional ocean-based activities, including seafood processing, sport boats and marine-based cosmetics, showing the potential of emerging ocean sectors.

Cruise shipping and liner shipping carriers were the best performing marine-based service industries during the same period, before the COVID-19 outbreak.

The period also witnessed China’s dramatic market share increase in certain industries, such as marine-based cosmetics, and an equally dramatic decline in other industries, such as exports of vessels.

Some medium and smaller-sized developing countries show promise in specific ocean economic activities, such as Peru consolidating its lead in fats and oils of fish or marine mammals and Singapore in maritime transport services.

“These new findings will help developing countries to identify new niches and successful entry and growth strategies, which are essential if they want to expand and diversify their exports in ocean-based sectors,” Mr. Vivas said.

Need for increased market access

The report offers new insights into market access challenges and opportunities for ocean-based sectors.

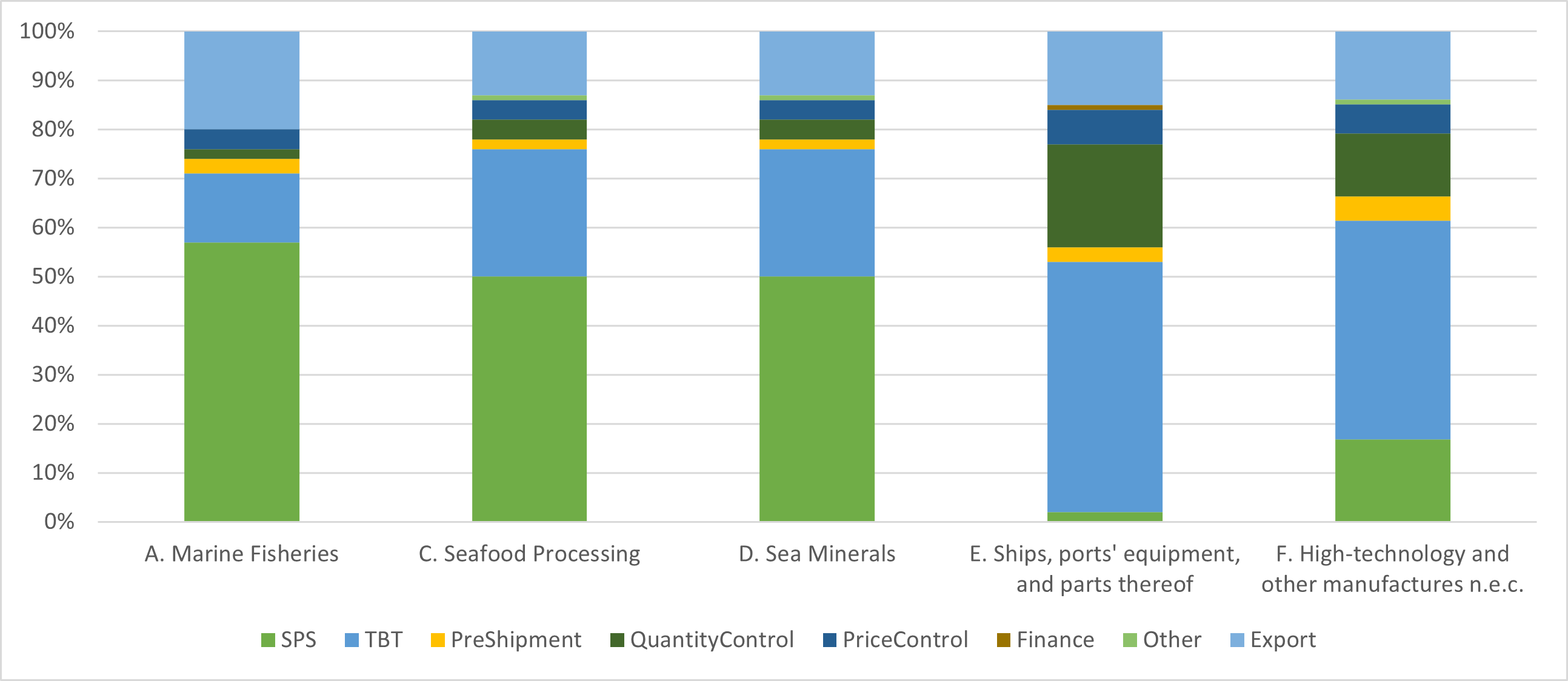

By reviewing each sector, the report finds mostly low average tariff levels. On average, tariffs are highest in least developed countries (10.18%), followed by middle-income (7.9%) and high-income (5.37%) ones. In contrast, the report finds widespread use of non-tariff barriers to trade in ocean sectors.

Countries are implementing numerous sanitary and phytosanitary measures (mostly on food products) and technical barriers to trade (mostly on manufactures).

Export restrictions are also emerging in both food and manufactured products. While these can have invaluable health and environmental benefits, they can also undermine developing countries’ participation in global trade.

Source: UNCTAD calculations based on UNCTAD TRAINS data (2020).

Businesses also contribute to this challenge by imposing on suppliers their sustainability standards. To expand trade in ocean-based sectors, countries need to build their capacities to comply with those standards.

Impact of COVID-19

Of the three largest ocean-based sectors, tourism was hardest hit by the COVID-19 pandemic, recording a 70% decrease in international tourist arrivals in 2020.

As countries reopen for tourism, UNCTAD is seeking to help them shift from business-as-usual to sustainable forms of tourism.

Maritime transport services were also affected by the COVID-19 pandemic as supply bottlenecks and a surge in demand led to the doubling of freight rates, with repercussions on consumers and countries most reliant on maritime freight, such as small island developing states.

To ensure countries recover rapidly from the pandemic and engage in sustainable ocean-based activities, the report recommends more widespread access to environmentally sound marine technologies.

“Countries need supportive measures such as trade and finance facilitation and diversification, access and transfer technology, regulatory harmonization and transparency,” said Claudia Contreras, an UNCTAD economist.

Also important is the building of national capacities so that each country has trained professionals to implement and apply such technologies.

And as demand surges for high-end products, countries will benefit from diversifying and upgrading their production towards niche and ocean-based activities with higher added value.