The rapid spread of coronavirus in early 2020 has had a major impact on global shipping markets, with the slump in demand for goods from China having a ripple effect on everything from container ships to oil tankers. Adele Berti of Ship Technology Global takes a look at how events have unfolded so far, and asks how the industry could speed up recovery in the future. Here is an excerpt of the article. Click here to read the full article published in the latest issue of Ship Technology.

Initially, everyone thought that it was China’s problem. Nobody thinks that anymore. The first country to be hit by Covid-19 is now the only one with a recovering economy and re-emerging population. For the rest of the world, uncertainty is the only certainty.

The soon-to-be global pandemic began in late December with only a dozen cases in Wuhan, China. The coronavirus outbreak has now tightened its grip on the entire world, with Europe as its current epicentre. As of 27 April it has now infected more than three million people and claimed more than 200,000 lives.

With Western countries now enforcing nationwide lockdowns that could last for months if not years, world economies are in danger of bleeding out. Numerous industries are at a standstill and the shipping sector is navigating uncharted waters.

Over the past two months, Ship Technology Global has been speaking to analysts and experts – both directly and indirectly – to offer a comprehensive view of how the global pandemic is affecting the industry.

While it’s almost impossible to make short-term forecasts for the shipping sector once the pandemic has slowed, Paul Cuatrecasas, CEO of investment banking firm Aquaa Partners and author of Go Tech or Go Extinct, believes the post-coronavirus years will be all about digital disruption.

In a media briefing held at the end of March, Cuatrecasas explained how the health crisis might spur investment in different segments of robotics and freight technology, which will in turn lead to a change in headwinds across the sector.

“Demand has dropped across the board, including at ports, the trucking industry, the shipping industry, almost anywhere you look,” he said. “Covid-19 has just slapped everybody in the face so get ready because what’s coming is going to be even greater disruption in different forms.”

But disruptive doesn’t necessarily mean damaging, as he mentioned the crisis could become a key catalyst for digital and technological advancements in the shipping industry.

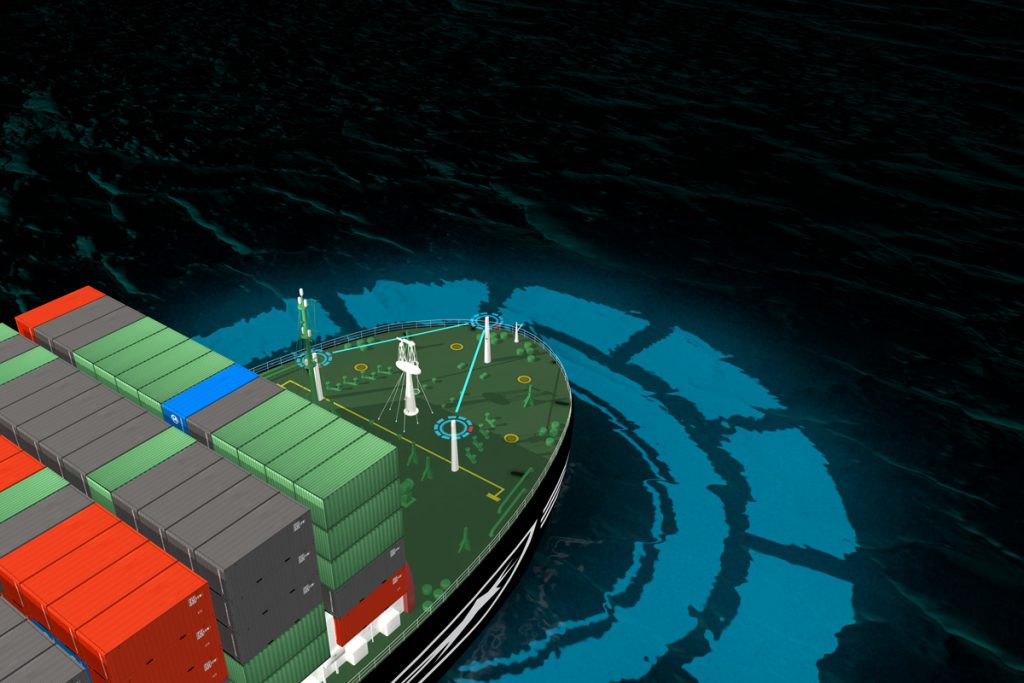

Change in these regards could be threefold. The first step will be increasing investment in freight technologies as well as companies providing data analysis, artificial intelligence software and overall end-to-end supply chain management. This will be key as it “reduces the shock, increases the resilience, [providing] more data, more information, greater ability to manage inventories to track the rates and timing of the shipping that is done”.

Increased investment in these segments will be accompanied by growth in the autonomous transportation sector, paving the way for autonomous shipping. “This is not just because [automation] is cheaper, or more efficient,” he said. “The nature of autonomous activities is one that can solve many, many problems, and deal with resilience in the core.” Lastly, there will be more space for cultured meat and fish, something that will disrupt the entire supply chain.

These will translate into the further evolution of e-commerce into a largely tech-savvy industry with cargo drones, 3D printers and robotics at its disposal. “Covid-19 will have a disruptive power across all industries but particularly in the supply chain and in the transportation sector, it won’t just be in the short term,” he concluded. “Investment into freight tech companies will help the existing industry to connect all the different players, shippers, brokers and carriers in the maritime basis to optimise current operations.”