Following a period of historically high freight rates, the Container sector is now experiencing a correction. The Container freight market is said to have peaked, as demand concerns linked to the health of the global economy have dulled sentiment somewhat. This has led to reduced demand across the Container sector, easing port congestion across Chinese and American ports and consequently softening charter rates.

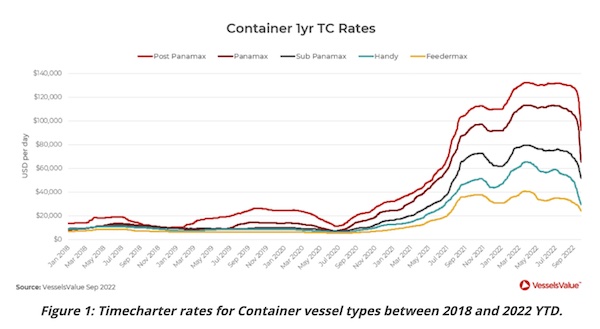

VesselsValue’s Panamax (4,250 TEU) one year time charter rates peaked at 99,000 USD/day in March this year. However, by the end of September rates had nearly halved, falling to 51,000 USD/day. For example, at the beginning of the year the 4,254 TEU Panamax Vela was fixed in February for 60 months at 43,250 USD/Day. Half a year later the CMA CGM Jamaica 4,298 TEU Panamax was fixed for 60 months, but only at 39,000 USD/Day. Figure 1 below shows the Timecharter rates for all Container vessel types, between 2018 and 2022 YTD.

Container values have risen steadily over the last two years until August, but following the pattern of the freight market, this sector has since seen a fall in values. For example, the price of a five year old Panamax Container ship has fallen by 25% from the highest point in April of USD 118.391 mil to USD 89.60 mil by the end of September. Moreover, the North Bridge (4,298 TEU, July 2006, Hyundai Heavy) was bought by MSC in February for USD 82.5 mil (a benchmark deal at the time), her value by the end of September had fallen to USD 51.56 mil.

Container Orderbook and Newbuilding Prices

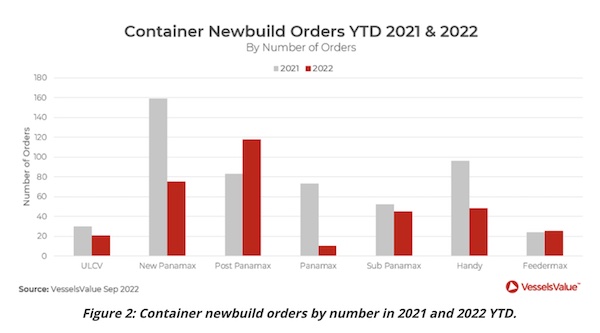

Demand for newbuildings has slowed over the year, as shipyard orderbooks reached capacity during 2021 when Container ordering reached record highs at 621 vessels equating to 3.9 mil TEU. For comparison, 2022 has seen just 355 newbuilding orders so far, nearly half that of last year. Figure 2 below shows the value of orders for Container newbuildings in 2021 and 2022 YTD.

The main type ordered in 2021 was New Panamax vessels of c.15,000 TEU by the likes of OOCL, COSCO Shipping, Seaspan, Evergreen Marine and Wan Hai Lines. This year however, we are seeing Post Panamax the favoured type with CMA CGM, MSC, Seaspan and Eastern Pacific all ordering 7,000-7,800 TEU vessels.

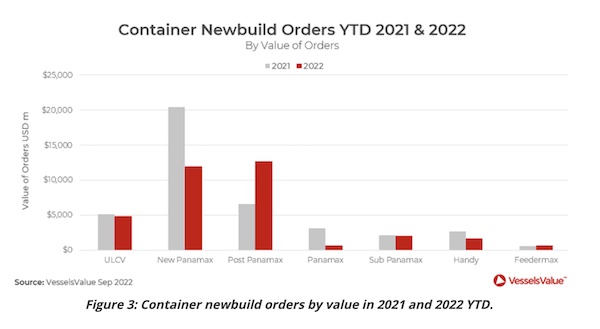

Average New Panamax newbuilding prices have fallen by c.6% from the start of the year from USD 281.30 mil to USD 263.63 mil at the end of September. However, the largest drop in values was in the Sub Panamax sector, where newbuilding prices fell by 17.2% from the start of the year to USD 51.47 mil. Figure 3 below shows the comparison in number of Container newbuild orders between 2021 and 2022 YTD.

Under normal circumstances, a fall in newbuilding prices would incite shipping companies to consider building new vessels. However, the unprecedented demand for new vessels over the last 24 months has made shipyards keen on maximising high prices at capacity, in order to meet demand and replace an ageing fleet.

Current Values

Sales liquidity is down for the Container sector which started the year with firm values. However, since the onset of rising inflation rates, demand has decreased and congestion at ports has eased due to Covid-19 restrictions being lifted, causing rates to decline. 539 Containers were sold between January and September 2021, and for the same period this year, only 270 vessels were sold. Whilst 95 vessels were traded on the S&P market in Q2 2022, more recently only 46 vessels were sold on the secondhand market in Q3, down 52%.

MSC was again the largest buyer with 7 vessels purchased, Wan Hai Lines was the second largest buyer with 4 Sub Panamax resales. Some notable sales include Northern Jupiter (8,814 TEU, Feb 2010, Daewoo) which sold for USD 134.0 mil, VV value USD 137.42 mil on the 5th July to Moller Maersk AS. Another was the Cap Capricorn (3,884 TEU, Oct 2013, Zhejiang Shipbuilding) which sold at the end of July for USD 75.0 mil, VV value USD 77.23 mil to CMA CGM.

With regards to values, in stark contrast to the exponential increase in asset values for Container vessels seen in the first three quarters of 2021, values for 2022 have on the whole decreased significantly with the biggest fall in 0 year old Feedermax vessels, falling c.35% since the beginning of the year.

Forecast

Congestion is still supporting the market but TEU volumes on the main trade lanes are slowing following a strong first half of the year and TEU miles are set to decline gradually in the second half of 2022. However, within Asia, the market has been showing signs of strength.

An increasingly muted outlook for economic growth combined with inflationary pressures, fears over a recession and interest rate hikes may take its toll on the market.

Fleet growth remains high with the orderbook currently at 30% of the existing fleet in July, the highest levels since the peak in 2008. Scrapping levels are low but we expect this to pick up as the market stabilises post 2022 and decarbonisation regulations come in to force.

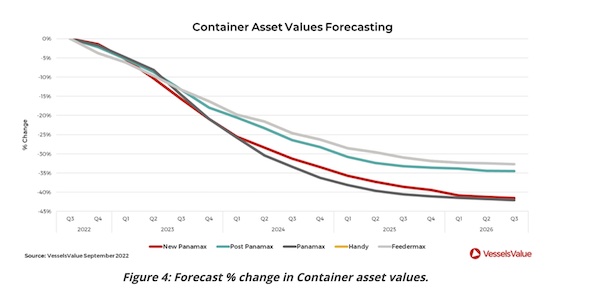

The market is expected to stay firm in 2022 due to persisting high congestion, but rates are trending lower following the peak in Q2. Figure 5 below shows the forecast % change in Container asset values.

Conclusion

Newbuilding prices will generally remain at current or higher levels through the coming year. Post 2023, total ordering activity is forecast to cool off as the appetite for new Container vessels declines. As the total orderbook declines and interest in new orders eases, we expect newbuilding prices fall towards the end of this forecast period. We also expect steel plate prices to have declined following very strong development through 2020 and 2021.

With reports of abandonment of ships contracted at higher prices over the last year, such as the situation with Seaspan, the experiences faced by the Container market over the last year is beginning to wane. Therefore, charterers tied into long term charters when the market was sky high will eventually be under pressure to keep operating those vessels, but at less profitable levels.

Source: VesselValue

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of the publisher